As cryptocurrency enters mainstream finance, Ethereum exchange-traded funds (ETFs) are making headlines with record-breaking inflows, highlighting a unique opportunity for investors ready to seize profitable digital asset opportunities. Recent data shows that U.S.-based spot Ether ETFs have achieved net-positive flows for the first time since launching in July—a landmark moment that’s reshaping access to crypto investments. At CriptoBeast, we’re here to guide investors like you through this evolving landscape, with insights, tools, and strategic support to make the most of this market momentum.

Record-Breaking Inflows Signal Strong Demand for Ethereum ETFs

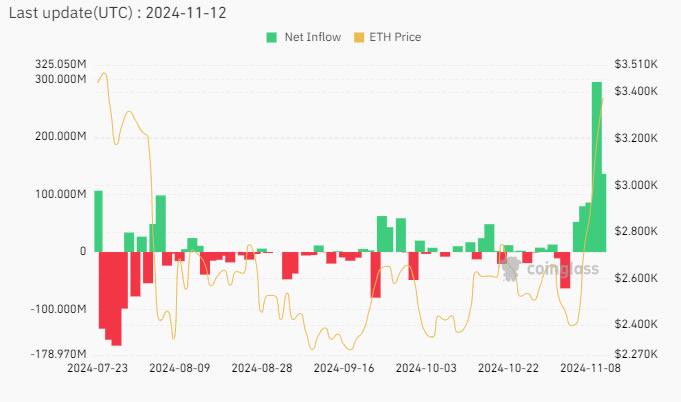

The numbers tell an impressive story: November 11 and 12 alone saw Ether ETFs bringing in a combined $431 million in net inflows, with $135.9 million coming in on the second day. This surge pushed the total net flows of nine Ether ETFs to a net positive of $107.2 million, as investors increasingly view Ethereum as a core part of their portfolios. Leading this charge, BlackRock’s iShares Ethereum Trust has brought in nearly $1.67 billion since its launch, with steady inflows and zero net outflow days, underscoring Ethereum’s strong appeal among both institutional and retail investors.

This remarkable inflow trend demonstrates that Ethereum ETFs are enabling traditional investors to access crypto exposure without the complexity of direct ownership. As these ETFs become a “bridge” to the crypto world, they’re attracting institutional interest that solidifies cryptocurrency’s position as a valuable, accessible asset class within the investment community.

Ethereum Joins Bitcoin in Attracting Major ETF Inflows

Ethereum’s growth is echoed by rising interest in Bitcoin ETFs as well, with spot Bitcoin ETFs bringing in an impressive $817.5 million in a single day on November 12. This dual momentum for both Ether and Bitcoin ETFs points to a broader acceptance of digital assets as integral parts of a diversified investment strategy. At CriptoBeast, we recognize this shift, and our suite of cryptocurrency investment services is designed to help investors capitalize on these opportunities with confidence.

Ethereum’s Market Cap Soars Amid ETF-Driven Interest

Reflecting these record inflows, Ethereum itself has surged, with its market cap surpassing $400 billion in the past week alone. The digital asset saw a 32% price jump in just five days, outperforming major assets such as Solana. As ETFs fuel mainstream adoption, we expect even more institutional and retail participation, which will only continue to reinforce Ethereum’s market stability and growth potential.

CriptoBeast: Your Partner in Seizing the Crypto ETF Opportunity

At CriptoBeast, we’re committed to helping you leverage the powerful momentum in the cryptocurrency market, providing expert-backed strategies and robust portfolio management to support your investment goals. Our investment products enable you to enter this expanding market with ease and confidence, guided by a team dedicated to securing your financial growth in the rapidly maturing digital asset space.

The Time to Act Is Now – Invest in Crypto with CriptoBeast

The bridge between traditional finance and crypto is now fully open, with record ETF inflows signaling an exciting future for cryptocurrency investors. As Ethereum ETFs drive access and adoption, CriptoBeast offers the guidance and resources needed to make the most of this market evolution. Now is the time to position yourself for strategic growth and to explore the high-potential returns that the crypto market offers.

As crypto ETFs reshape the market, let us help you take the next step in your financial journey with expert-driven insights and innovative investment solutions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Dai

Dai  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Optimism

Optimism  Injective

Injective  dogwifhat

dogwifhat  Notcoin

Notcoin  Dutch

Dutch English

English French

French German

German Italian

Italian Portuguese

Portuguese Russian

Russian Spanish

Spanish