The meme coin PEPE recently experienced a significant 15% price drop, pushing it into what analysts often call an “Opportunity Zone.” Trading at around $0.00000818, PEPE fell below a critical support level, which has sparked considerable interest and analysis in the crypto space. This post dives into the technical and market indicators surrounding PEPE’s recent moves and examines whether this downturn is an opportunity or a warning.

PEPE’s Technical Indicators: MACD & MVRV Analysis

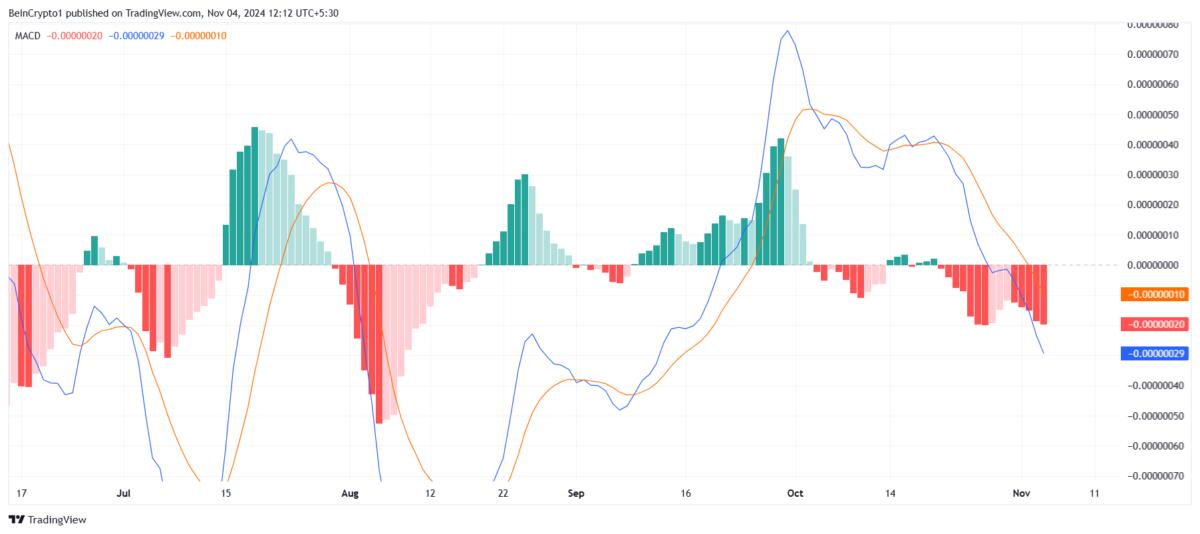

PEPE’s technical outlook is currently a mix of caution and opportunity. The Moving Average Convergence Divergence (MACD) indicator reveals a bearish trajectory, suggesting sustained selling pressure. Typically, when the MACD trend lines point downward, it indicates continued downward momentum, warning short-term traders of potential losses.

However, PEPE’s Market Value to Realized Value (MVRV) ratio has dipped into an interesting zone, falling between -8% and -24%. This range, often called the “Opportunity Zone,” suggests that PEPE may be undervalued relative to its realized value, a metric that compares an asset’s market cap with the value holders paid to acquire it. Historically, this MVRV range has marked a price floor where selling pressure declines and accumulation activity increases.

Understanding the “Opportunity Zone” for PEPE

The current MVRV ratio indicates that PEPE’s valuation may be entering an accumulation phase. Investors who purchase in this range typically aim to capitalize on lower prices, banking on a price rebound once the market stabilizes. If this trend holds, we could see increased buyer interest, which may act as a catalyst for PEPE’s price recovery.

At its current price, PEPE has broken below previous support at $0.00001000 and is now aiming to regain stability around $0.00000839. Should buying activity increase at this level, it could re-establish $0.00000839 as a support floor, potentially setting PEPE up for a bullish trend toward $0.00000999.

Risks to Consider

While the “Opportunity Zone” signals a potential buying opportunity, it’s crucial to remain aware of PEPE’s ongoing bearish momentum. If the buying momentum does not materialize or falls short of expectations, PEPE’s price could drop further, pushing it below $0.00000800, a level that may invalidate the potential for recovery in the near term.

Key Takeaways for PEPE Investors

For investors looking at PEPE, the current price dip presents both an opportunity and a risk. The MVRV “Opportunity Zone” hints at a possible accumulation phase, but the bearish indicators suggest that caution is warranted. Monitoring key levels, particularly $0.00000839 as support, will be crucial in assessing PEPE’s next moves.

At CriptoBeast, we continue to analyze market trends and support our community with timely insights. Stay tuned as we monitor whether PEPE can recover from this bearish spell or if further declines are on the horizon.

Stay up-to-date with CriptoBeast for the latest on market opportunities and strategies to navigate the crypto market’s ups and downs.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Dai

Dai  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Optimism

Optimism  Injective

Injective  dogwifhat

dogwifhat  Notcoin

Notcoin  Dutch

Dutch English

English French

French German

German Italian

Italian Portuguese

Portuguese Russian

Russian Spanish

Spanish